The D&O Contract Vigilance Blueprint

A 5-Day Course About The 5 Fatal Mistakes That Can Leave Directors and Officers Exposed to Unseen Risks, Leading to:• Personal Liability

• Legal Battles

• and Financial Ruin- And How to Safeguard Against Them

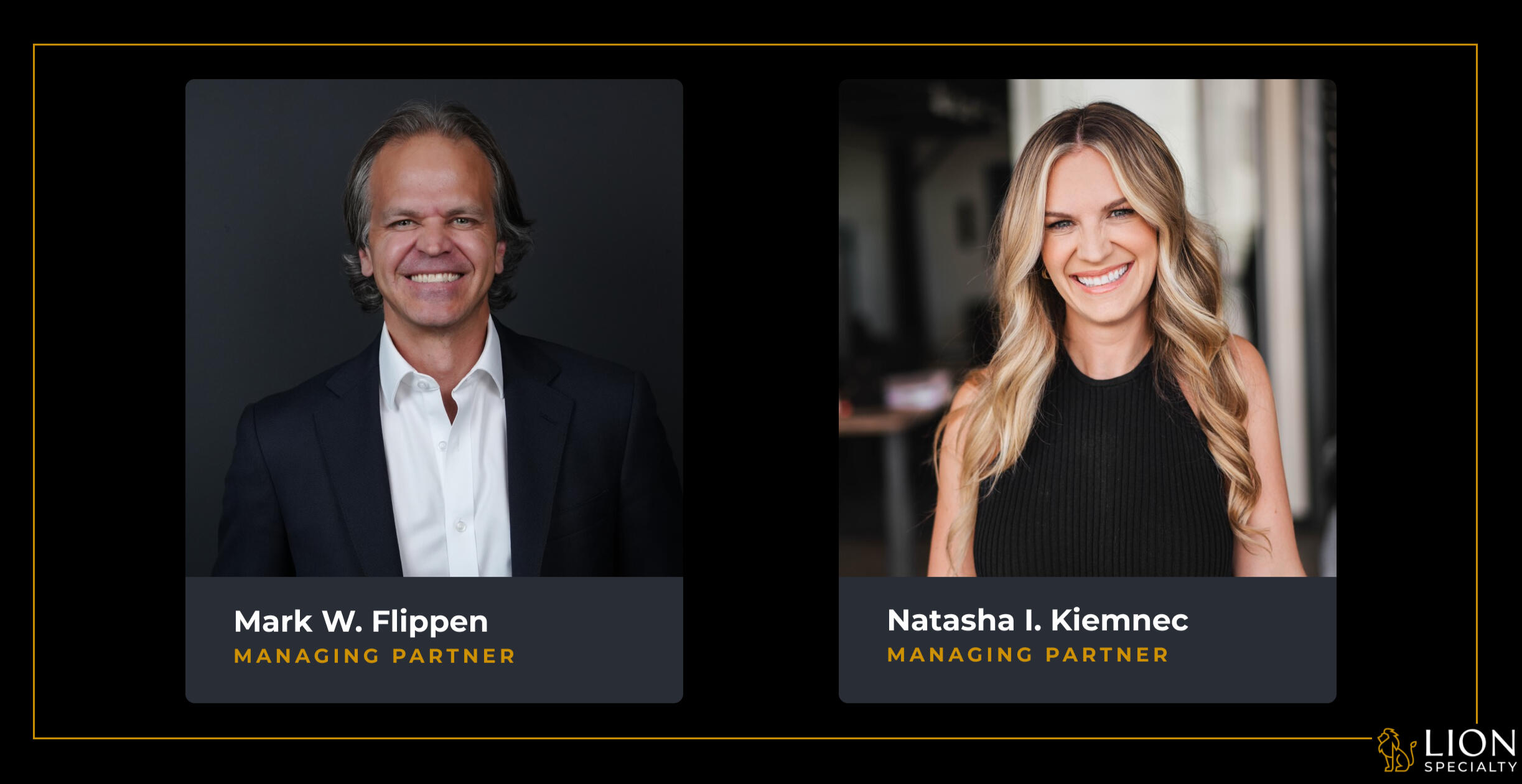

Authored by Natasha Kiemnec & Mark Flippen, Managing Partners & Co-Founders of LION Specialty who’ve adjusted $250M+ in claims for Financial Institution clients.

This free course will teach you how to bulletproof your D&O insurance contract and protect your directors and officers from catastrophic coverage gaps.

Written by Industry Experts With 135,000+ Hours of Experience

What people are saying about LION Specialty:

Is this for me?

If any of these sound familiar:• You're a risk manager, CFO, General Counsel or board member responsible for safeguarding your company and leadership• You've heard horror stories of D&Os being personally sued and want to make sure you're protected• You suspect your current D&O policy has dangerous gaps but don't know how to identify them• The pages of dense legalese and insurance jargon in your policy make your eyes glaze over• You want to be able to reassure your board that they have the broadest possible D&O coverage• You'd sleep better at night knowing your D&O contract is airtight and your assets are secure...then this course is for you.

See, buying D&O insurance isn't enough.You could be exposed and not even know it.One misplaced word, one missing clause in your policy could mean the difference between ironclad protection and financial ruin.We've seen it happen. Seemingly solid D&O contracts that disintegrate when put to the test, leaving stunned directors and officers holding the bag.It doesn't have to be this way.Armed with the right knowledge, you can:• Shut those gaps

• Negotiate powerhouse policy language

• Give your leadership true peace of mindThat's what this course will teach you.

What's inside?

Day 1: Mistake #1: Ignoring Fraud Exclusion Terms - Lessons from a CEO Left High & DryDay 2: Mistake #2: Overlooking Allocation Clauses - Don't Let Insurers Offload The Bill On YouDay 3: Mistake #3: Underestimating the Hammer Clause (And How to Avoid Getting Forced into Lowball Settlements and Getting Stripped of Your Coverage)Day 4: Mistake #4 Misinterpreting Materiality Standards (Why Even Innocent Mistakes on Your Application Can Void Your Policy)Day 5: Mistake #5: Neglecting Nominal Defendant Coverage (And Why This Leaves Your Company Itself Paying Legal Costs in Certain Lawsuits)COURSE COMPLETION BONUS: Complimentary review of your existing D&O policies

Still not sure if The D&O Contract Vigilance Blueprint is for you?

We get it.Your plate is full and your time is precious.Another course may seem like just another demand.But consider the stakes.Gaps in your D&O contract aren't just an "oops." They're a ticking time bomb that can explode your professional and personal life.All it takes is one lawsuit.If it hits and that clever plaintiff attorney finds a tiny oversight in your D&O, you could be staring down:• 7-figure legal bills

• Personal liability and asset seizure

• Angry investors and shareholders

• Reputation damage

• Regulatory backlash

• Career derailmentIt's a lot to risk.Especially when you can shut down those dangers with a small time investment now.That's why we distilled our combined decades of experience structuring elite D&O programs into this quick-hit masterclass.We've written these emails in a simple, approachable matter -Even a teenager can understand it.So you can spot the contract pitfalls that leave you exposed and plug them fast, no matter how busy you are.Because the truth is, you don't rise to the level of your D&O coverage. You fall to the level of your gaps.We're here to make sure you don't have any.Let us show you how.

Look at the entire curriculum of the course (entirely free):

Day 1: Mistake #1: Ignoring Fraud Exclusion Terms• The sly wording change that lets insurers deny claims for mere fraud allegations, not just convictions

• How "dishonesty" clauses give insurers broad leeway to rescind your coverage

• The critical language to demand for an insured-friendly fraud exclusionDay 2: Mistake #2: Overlooking Allocation Clauses - Don't Let Insurers Offload The Bill On You• Why "relative exposure" language sticks you with more than your fair share of costs

• The must-have clause to ensure equitable allocation that your insurer can't manipulate

• Real court case reveals how one little-noticed allocation term saddled a policyholder with millionsDay 3: Mistake #3: Underestimating the Hammer Clause (And How to Avoid Getting Forced into Lowball Settlements and Getting Stripped of Your Coverage)• The quiet clause that lets insurers force you to settle, then abandon you

• How a single rejected settlement recommendation can strip you of coverage

• The policy tweaks to negotiate so you retain settlement autonomy

Day 4: Mistake #4: Misinterpreting Materiality Standards (Why Even Innocent Mistakes on Your Application Can Void Your Policy)• The sneaky contract trick insurers use to turn any application misstatement into grounds for rescission

• Why "representations" language matters more than you think

• How to ensure only truly material errors put your coverage at riskDay 5: Mistake #5: Neglecting Nominal Defendant Coverage (And Why This Leaves Your Company Itself Paying Legal Costs in Certain Lawsuits)• Why you're still exposed in derivative suits even if only your directors/officers are named

• The A-side language needed to shield your corporate entity from derivative legal costs

• Painful real-world example of a company left holding the bag without nominal defendant wording

© LION SPECIALTY LLC. All rights reserved.